Another 'balanced' dilemma

Feb 27, 2025

I have made another blog post in the past about another super fund’s “Balanced” option. Note – these blogs are just general in nature and not advice, all I am trying to do is highlight that what something looks like on the outside, isn’t always the case on the inside. Case in hand this time is First Super.

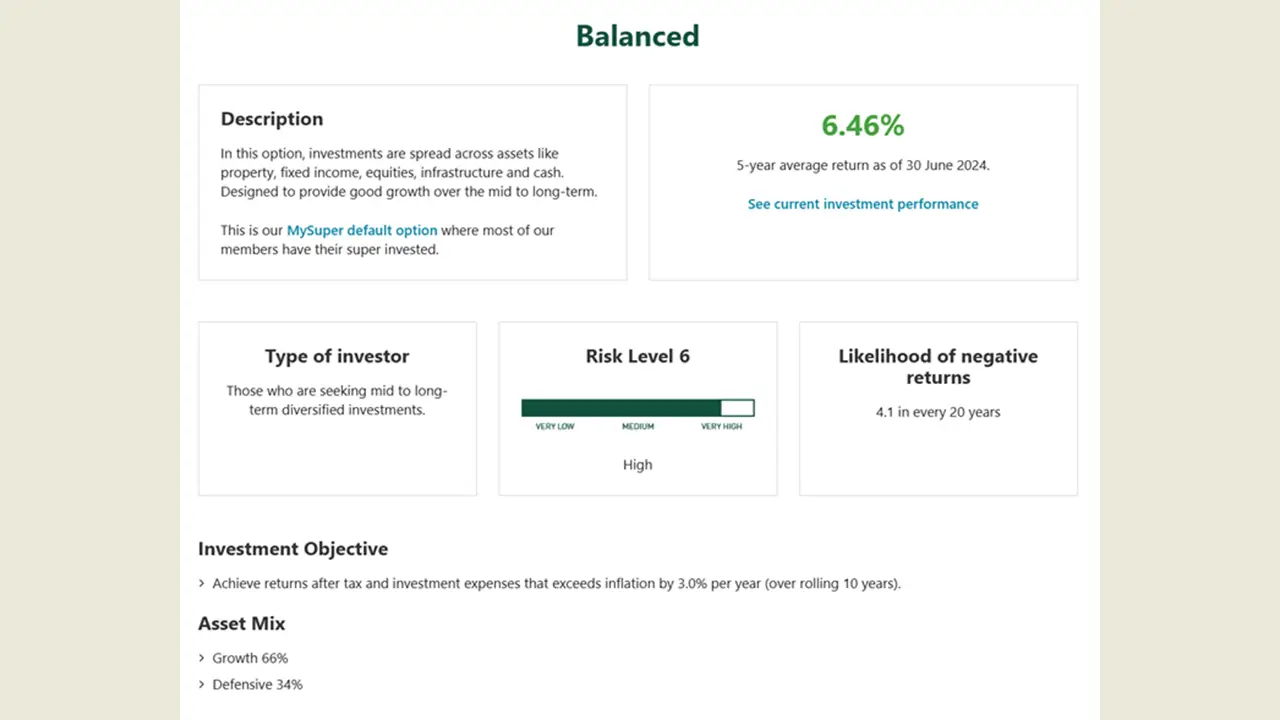

Their “Balanced” option highlights as per the below that their fund contains 66% growth assets and defensive of 34%. This actually doesn’t sound too bad compared to other “Balanced” fund’s on the market in terms of it doesn’t carry as many growth assets as others.

However, when we actually drill into the pie chart and the breakdown, I believe they are misinterpreting what is a defensive asset (which they think is 66% as noted above).

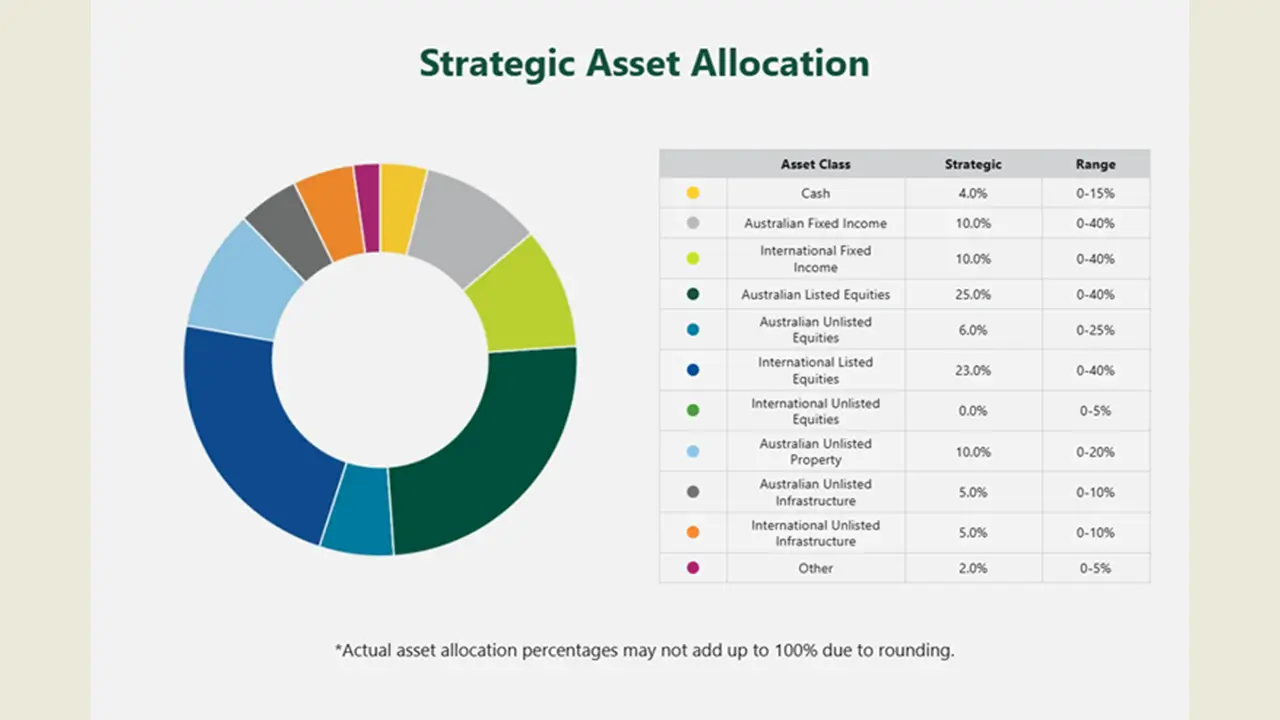

When I look at the pie chart below I can really only see 3 defensive assets totalling 24% - i.e. Cash (4%), Australian Fixed Income (10%) and International Fixed Income (10%).

Again, people/companies can call a growth asset what they want and a defensive asset what they want – whether it is right or not is up for interpretation.

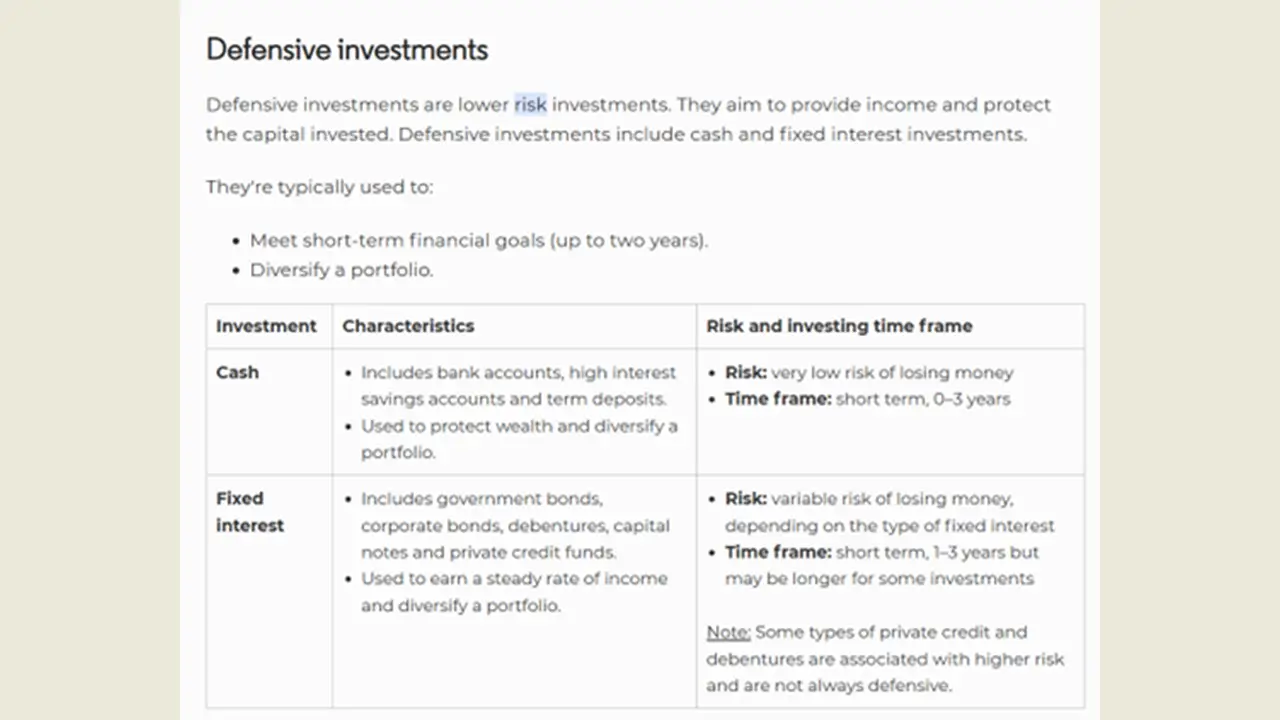

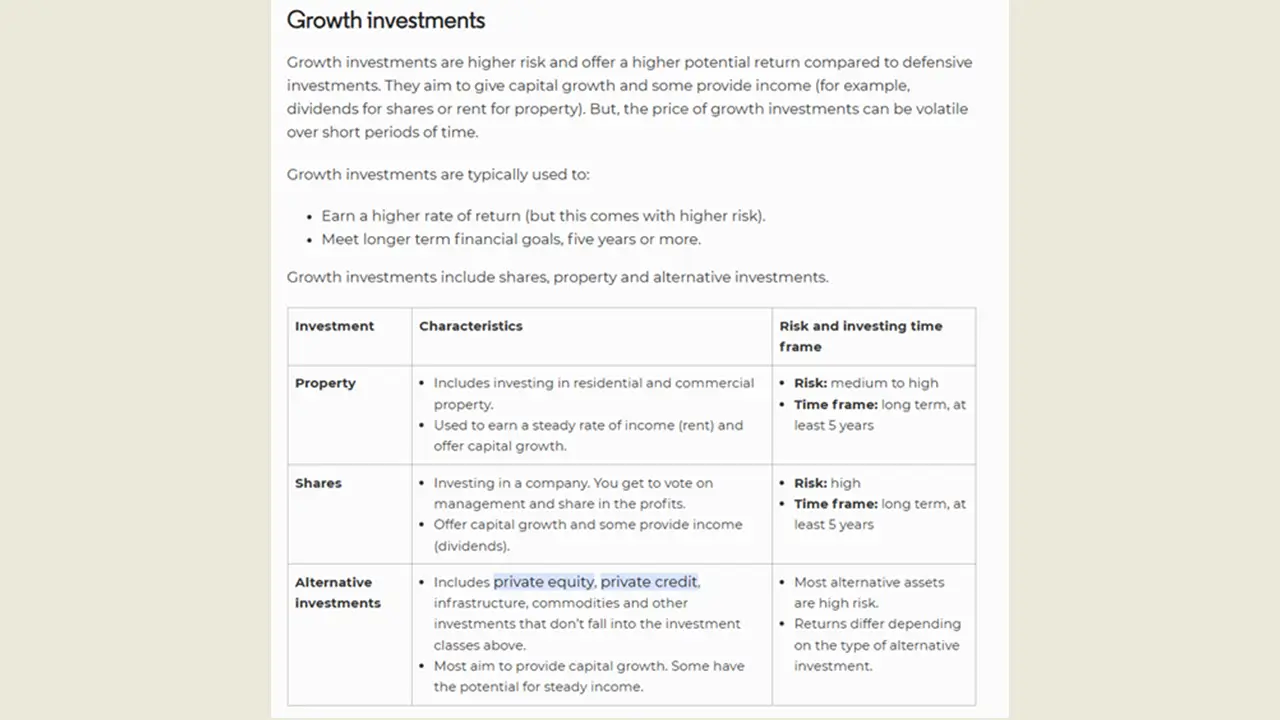

After a quick google search of the Moneysmart government website – their interpretation of a defensive and a growth asset aligns with mine as below:

Again, I am not saying the “Balanced” option with First Super is good or bad – rather I am just highlighting the importance that before you invest in something, it is important to get advice and drill into the finer details to see what you are actually investing in and not just take the “headline” information as being 100% correct.