“I’m with AustralianSuper and invested in the Balanced option.”

Sep 4, 2024

When I hear this statement and ask a client what it means to them. They usually think of the “Balanced” option like a seesaw, such that if you are sitting on one end of a seesaw and someone of equal weight is sitting on the other end – the seesaw doesn’t move. This is because they are equal 50/50 weight and are truly “balancing” each other out.

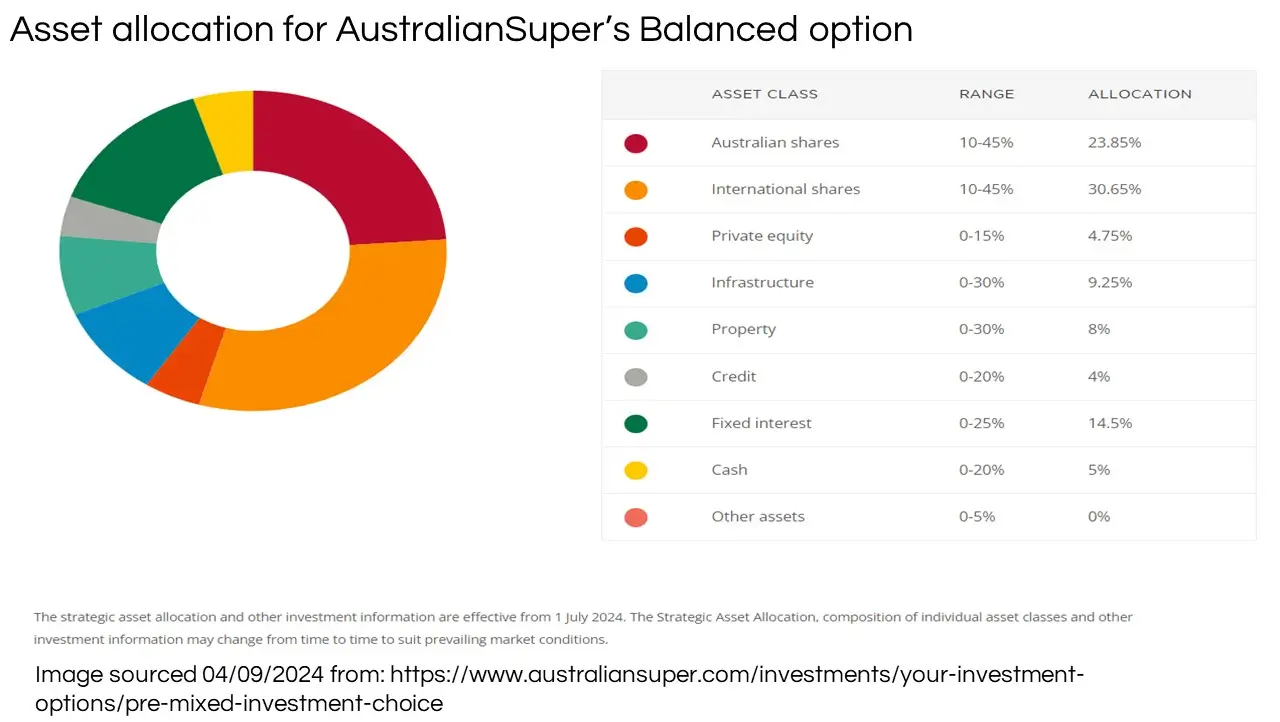

However, when we look at what the AustralianSuper Balanced option is invested in (as per the image above) – it to me has growth assets of approximately 76.5%. Some people identify growth assets differently, my calculation/interpretation to get to 76.5% is taking into account Australian Shares, International Shares, Private Equity, Infrastructure and Property – which I consider “growth assets”. These are generally but now always more volatile than “defensive assets” such as Credit, Fixed Interest and Cash. So, with 76.5% in growth assets this leaves only 23.5% in defensive assets.

This differs from some consumers who are thinking their “Balanced” option is like a seesaw with a 50/50 split between growth and defensive assets. It is important that regardless of which fund you are in, you have an investment strategy that aligns with YOUR needs. When you are trying to compare – just remember a “Balanced” fund may not be your version of balanced, also each super fund has their own interpretation of what their “Balanced” fund comprises of.