Jun 15, 2025

This is a myth and I hear this getting mentioning quite often when people think having SuperSA Triple S (being a SA Government fund) is safer than other super funds. Just because it is state government run – it does not provide any extra security with how your funds are invested and the risks compared to any other super fund that invests money on your behalf.

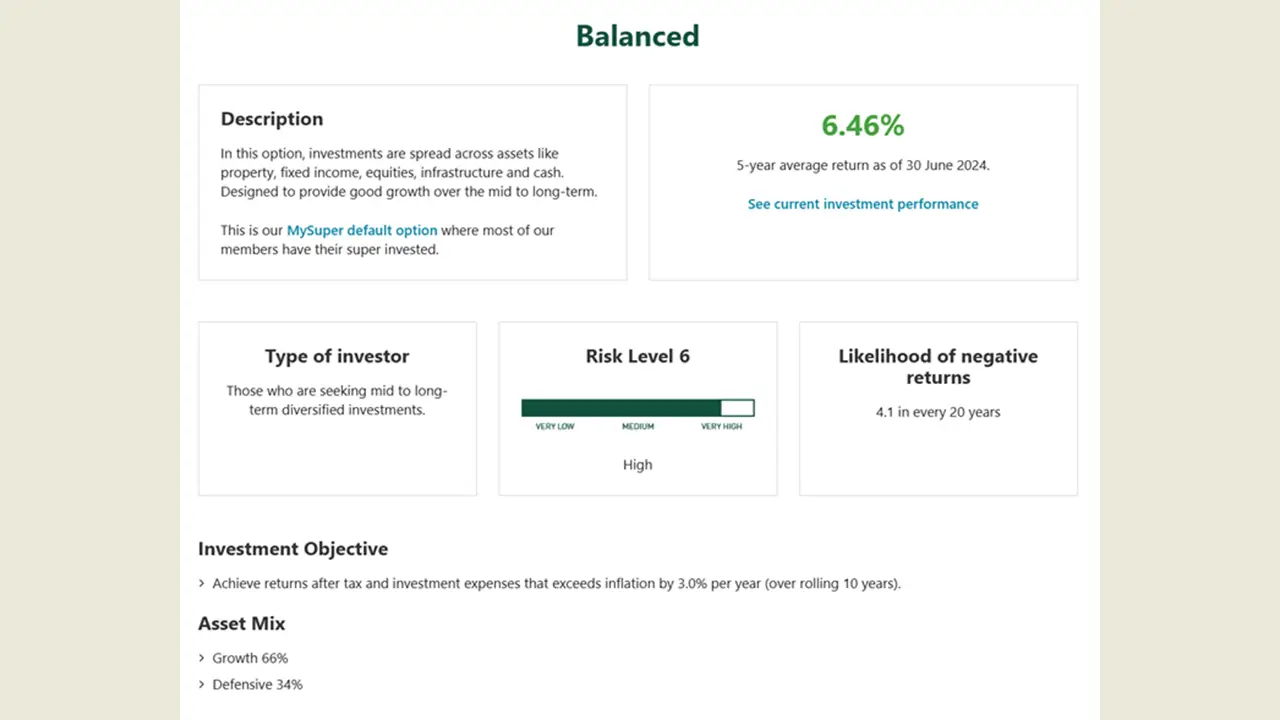

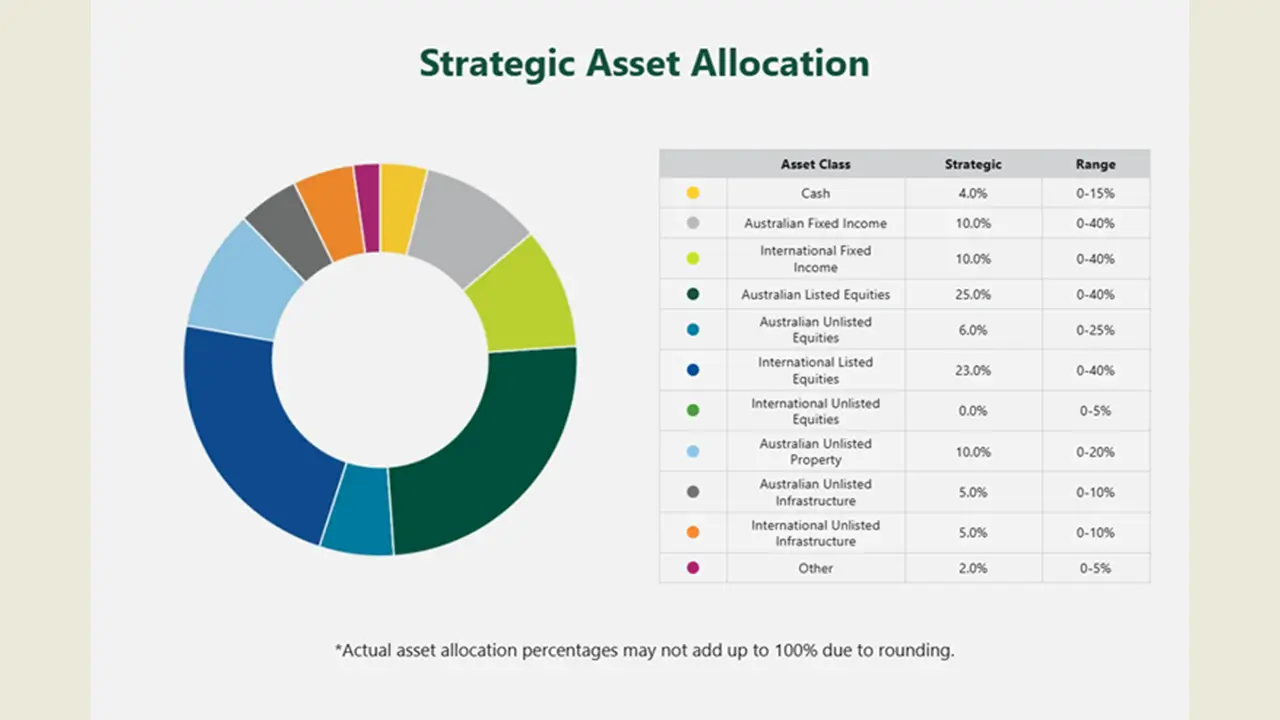

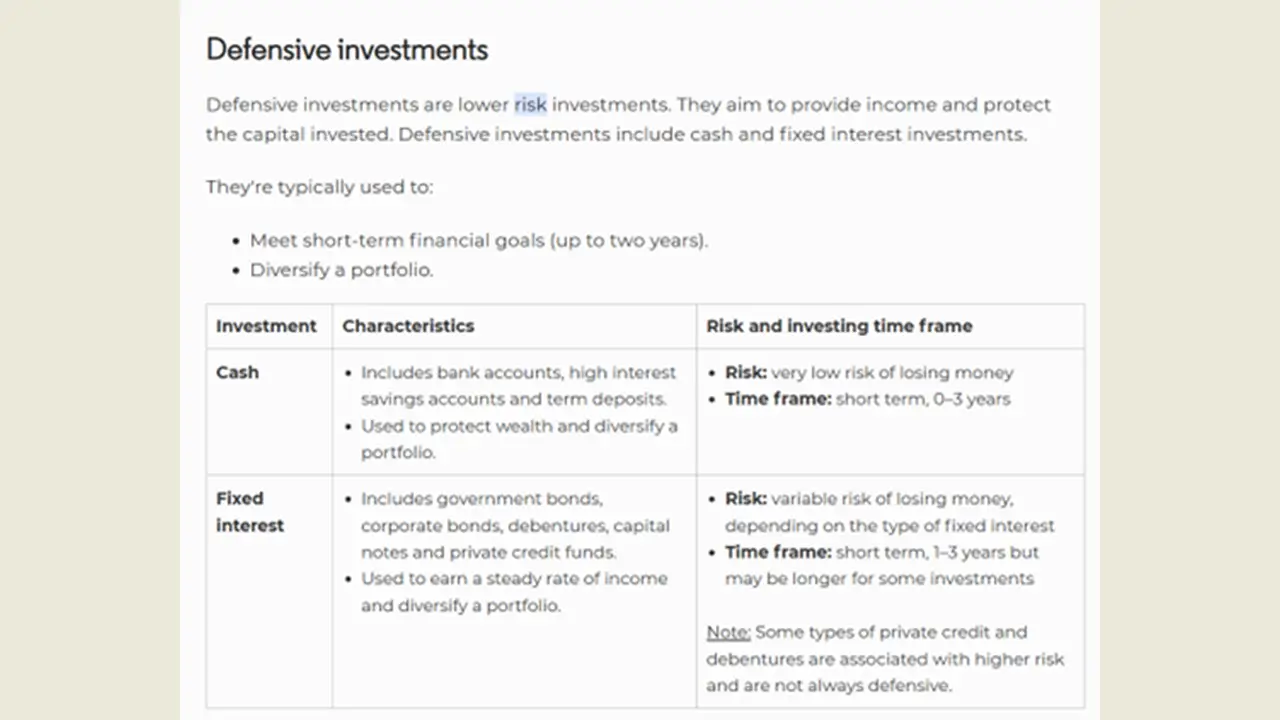

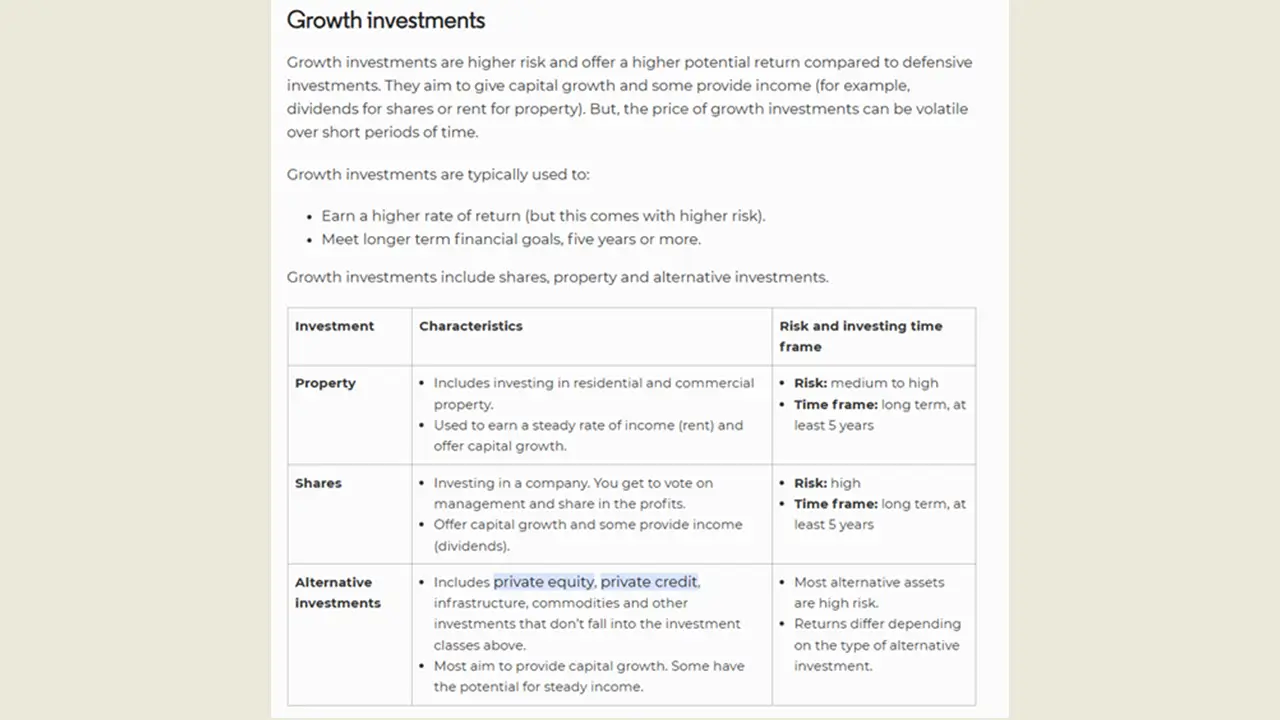

Ultimately when I hear people saying “safe” they are referring to the chance of losing capital value of their investments. When in reality what it really comes down to is how you invest your superannuation fund in terms of the types of assets you carry which will determine how “safe” your fund will be. For example if you compare SuperSA Triple S and an investment within it that carries lots of shares compared to another industry fund with an investment that carries a lot of shares, being a government fund it doesn’t provide any additional security and your performance and risks of losing or gaining money comes down to what your invested in.

SuperSA does have other funds though (some older schemes) which have a defined benefit value (usually calculation based with things like length of service and salary) – these funds are maybe where the rumours start of SuperSA being “safe” …